Section I – Where are we now?

Strangely, and despite the worsening current economic situation, the stock markets are soaring, commodities like Gold are skyrocketing, and cryptocurrencies are moving higher and higher.

A scene that nobody expected to see, especially during a time where many big economies like the U.S, U.K, and the Eurozone were hit with the COVID-19 pandemic that caused their GDP to fall sharply by 9% or more!

It is surely an interesting scene to see the world recover rapidly from the aftermaths of the COVID-19 pandemic, but this makes it as well somewhat suspicious. Why are stocks, gold, and cryptocurrencies going up at the same time? And why are they all at or near all-time highs concurrently… we would say this looks too good to be sustainable.

So, the puzzling question here is: how can Stocks and other assets be at all-time highs during a pandemic and a worsening economic data? Isn’t this counter-intuitive?

Well, we might have a somewhat reasonable answer for this, and it is in the following chart:

To begin with, let us explain the chart above. The Blue line illustrates the “M2 Money Supply”, which is an indicator of money supply provided by the Federal Reserve (The Fed).

The Red line represents the S&P500, and one can notice that it began to drop with heavy momentum in February 2020. Everyone from long-term investors to retail traders were selling stocks aggressively and nobody was buying. This caused the S&P500 to drop by 35% nearly in less than 35 days. However, if this continued to be the case, the S&P would meltdown, leading to major damages to the U.S. companies and overall economy.

So, guess who came to the rescue? You guessed it: The Federal Reserve with its new money (i.e. the Blue line in the chart above). The Federal reserve started a spending spree to save the economy. They did this through various operations, such as: $1.5 Trillion worth of capital injection[1], buying corporate debt and junk bonds, and making “Main Street loans”[2].

The result? the Federal Reserve successfully helped the S&P 500 recover and it made a new all-time high in short period of four months afterwards.

Once you understand this, you no longer can believe that we are seeing a healthy organic bullish market anymore.

Section II – Fear and Greed

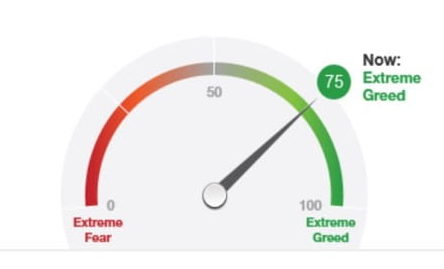

Everyone is winning. Profits are made in almost anything you invest in, and life is just good for any traders nowadays. So, I wonder what is the Greed level right now? Let us have a look!

Traditional Markets:

Cryptocurrency Market:

In such environment, this famous quote should ring a bell:

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”

– Warren Buffet

Section III – What are the events that can cause unexpected movements?

There are a few events that can cause unprecedented movements in the markets. Firstly, there is a serious house eviction crisis that is just about to explode in the U.S. and we are sure the market is not ready for it!

Why would this happen? Because when the COVID-19 pandemic began to affect U.S. businesses in March 2020, a combined effort between different U.S. States and the Federal government has led to the introduction of eviction bans and the CARES Act; which protects people from being kicked out from their homes during the pandemic. However, these eviction protections expired on July 31st. This can cause a very serious explosion of homelessness, according to a recent estimate by CNBC[3] and MarketWatch[4] up to 40,000,000 (yes you read that correct, 40 million!) Americans are at risk of being kicked out of their homes in the not far future. For comparison this is 4 times bigger than the evictions that happened during the Great Recession[3] in 1928.

Secondly, a big wave of liquidity crisis is about to start. The same CARES act mentioned earlier allowed unemployed people to receive up to $600 weekly in unemployment benefits. But again, these benefits expired on July 31th which means all these unemployed people who were living on essentially government support could all of a sudden find themselves bankrupt and unable to meet basic needs (rent, bills, food). Regardless of whether the U.S. government will pass a new bill to extend these benefits, the harsh fact is that they cannot continue to support the population forever, so when the government stops sending “helicopter money” to support the people, this wave will explode strongly.

Thirdly, banks know what is coming next, and they are getting prepared silently. With everything stated above, one can only expect a big increase in loan defaults. If people cannot meet their basic needs, then we can logically say that they will not be able to pay their loans too. So, what did the banks do to prepare for this?

Look at these charts:

What a coincident isn’t it? Banks have “conveniently” and very timely in Q1 2020 started to sharply tighten the standards for everyone from consumers to small businesses to big companies to get any kind of loan. In fact, the standards have been tightened so much that in some categories it is now harder to get a loan than it used to be during the Financial Crisis of 2008. So, what does this tell us? The answer is simple: Banks are fearful of granting new loans to everyone because they are expecting a big rise in loan defaults[5].

Section IV – What is Uncle Bull’s comment on this?

Unemployment levels are at record highs, meaning there is less chances for anyone to get a job (i.e. salary). People are living on government support money that can end at any point of time. With 40 million people expected to be evicted, Banks are making it extremely difficult to get any kind of loan, meaning that Dollars are harder to acquire for the average person or business now than ever. Thus, Banks are preparing for what they expect to be a big rise in loan defaults. All of these signs indicate that there is a shrinking liquidity in the market.

For those who argue about the newly printed dollars, these “new” dollars are being parked (read our previous article here). In other words, and as we said above, banks are fearful of giving new loans which means that the newly printed dollars are not being injected into the economy. Therefore, it doesn’t matter how much money is being printed, they will have no effect as long as they don’t enter the market!

Section V – What does Uncle Bull expect to happen next?

“It is all a big bubble that was inflated by the Federal Reserve. And regardless of how strong they are, at some point, they will no longer be able to hold it.”

– Uncle Bull Group

For this part, we will not get into too much details. We will lay out the scenario that we see coming, and with any luck, it is going to be in the following order:

- Increased Unemployment: No jobs = no income = no money to pay bills = more bankrupt people.

- Tightening Bank Standards for Loans: Hard to get loans = no easy money = hard to get dollars = DEFLATION.

- DEFLATION = Stronger dollar. Stronger (i.e. more expensive) dollars usually lead to a flee of investors from risky assets (Stocks, cryptos, etc.) and sometimes from Safe havens, back to the “stable” Dollar.

- Investors fleeing to US Dollars leads to massive crash in all risk assets (Stocks, cryptos, and it can affect other markets too)

- This crash will last 1-2 years (take this with a grain of salt) until the economy starts to absorb the shock and move on.

- Loans will gradually become easier to obtain, and with an enormous amount of money available to lend, the banks will be giving loans at an incredibly fast pace! (The fed printed a lot of money, but it was parked and not moving, remember?).

- Banks loaning at a faster pace will create a new “Easy money” phenomena, and this will cause the economy to start recovering again, as this will enable more businesses to (re)open and more jobs can be created.

- Loans will be increasingly popular again, and banks will be lending to everyone they can.

- Loans granted to everyone essentially will cause inflation to pick up sharply. No central bank (not even the Federal Reserve[6]) will intervene to control it.

- Inflation will lead to massive price increases, and essentially result in a weaker dollar, again.

- Safe Havens like Gold and Silver (probably Cryptocurrencies too) will skyrocket, while traditional fiat money will depreciate.

- A new digital version (Can’t believe? The IMF posted this) of fiat currencies, perhaps a Digital Dollar will be introduced to replace fiat. And ultimately allow greater control over money supply.

- To be continued…

[1] https://markets.businessinsider.com/news/stocks/fed-repo-trillions-added-to-fight-coronavirus-economic-risk-recession-2020-3-1028991278

[2] https://www.cnbc.com/2020/08/10/the-fed-bought-more-blue-chip-and-junk-bonds-and-has-started-making-main-street-loans.html

[3] https://www.cnbc.com/2020/07/30/what-its-like-to-be-evicted-during-the-coivd-19-pandemic.html

[4] https://www.marketwatch.com/story/calculating-americas-eviction-crisis-up-to-40-million-people-are-at-risk-of-being-kicked-out-of-their-homes-2020-08-07

[5] https://www.wsj.com/articles/this-is-not-a-normal-recession-banks-ready-for-wave-of-coronavirus-defaults-11594746008

[6] https://www.marketwatch.com/story/fed-unanimously-adopts-new-strategy-widely-seen-as-leading-to-easier-policy-2020-08-27